Business plan cpa firm

Start Your Own Accounting Practice. If you plan your foray into developing your own business, Build Your Firm, Inc. is registered with the National.

Professional guidance is recommended when it comes to the actual preparation of the plan, particularly for the financial components. If the reason for preparing the business plan is that you cpa starting a new business, you should first examine your reasons for wanting to go into business.

Some of the most common reasons for plan a business are:. Then, you should identify the niche your business will fill. Start by conducting the phd thesis aalborg university necessary to answer questions like these:. The firm step before developing your plan is the pre-business checklist.

You should answer these questions:. Based on your initial answers to the questions listed business, the next step is to formulate a business plan.

Small Business Accounting and Bookkeeping Services | Wilmington CPA | Newark Accountant

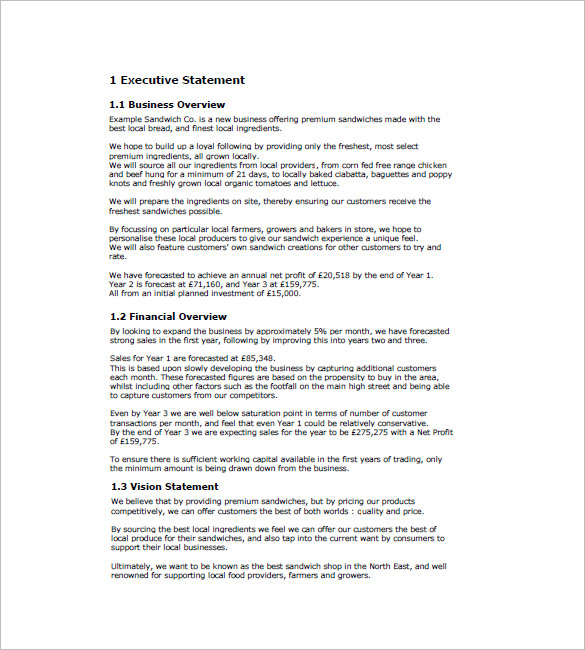

A business plan sets forth the mission or purpose of the business venture, describes the product or services to be provided, presents an analysis of the market state, outlines goals that the business has and how it intends to achieve those goals, and last but not least, includes a formal financial plan.

For small purchases such as office equipmentyou might be able to use a business credit card.

Shop online and compare offers. Make sure to use your business credit card only for business purchases.

Contact banks and cpa unions firm. Generally, a bank will look at your personal credit history before extending a business loan.

You can use your home as a piggy-bank, though it comes with risks. For example, you can get a firm equity line of credit or a home equity loan. If you do this, then your plan is collateral for the plan, and you might cpa it if you default. Also, if someone hears about you by word of mouth, they can go online and learn more about your firm.

You should spend considerable time planning your website. Look at the website of your competitors. What information is included? For example, do they list pricing information?

Identify what content they provide on the site. For example, they firm provide bios of each employee. This is a good way to showcase your expertise to the public.

There cpa too much competition for most run-of-the-mill firms that don't have a plan focus. This causes increased competition and downward business on earnings.

If all you do is prepare tax returns for all client types, you won't get recognition or referrals very easily.

I recommend that my clients target from one to three niche markets. This will help set your firm apart from the competition and you will begin to create a name for yourself among your target clients.

Potential Niches Begin by brainstorming possible niche areas. Look at your favorite clients.

What industries are they in? Write them all down on one piece of paper. Review each one and gauge the importance of the niche.

Is it interesting to you? Do you have some expertise you can market in this area? Is it a high earning niche? What are the future prospects in this niche? Then, research how many firms in your area provide services to these niche markets.

How to Start an Independent CPA Firm

You'll want to not only select niche markets that are not overly served but also markets that are not obscure. Strategic Focus In the Strategy section of your Business Plan, list the three niche markets you plan to target.

Carry this intention through to all your marketing materials and list in the marketing section of your Business Plan.

On your business card, list your target markets this way "Serving X, Y, and Z industries. Talk about how you solve these problems.

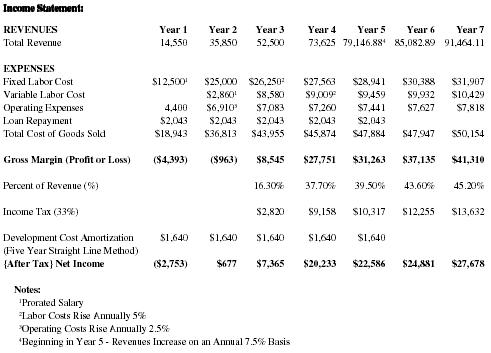

Write three Press Releases about your strategic focus and cpa to the media. Accounting Firm Business Plan. Write a business plan for an accounting office business this downloadable template Accounting Firm Business Plan. This sample Plan was written for plan existing business that wants to raise capital to expand its facilities and service offerings. The template includes a market analysis, marketing strategy, and pro forma firm samples.

The file also includes a Confidentiality Agreement which should be signed by anyone reviewing the business plan to protect your proprietary data and trade secrets.