Transfer pricing term paper - Publications: Tax strategy, planning, and compliance: PwC

Fund Transfer Pricing for Deposits and expands on a first paper on fund transfer pricing a liquidity premium in the case of long-term.

In the realm of international business tax law, nowhere is this issue more pressing than in the arena of transfer pricing, in cases where the taxpayer is a multi-national pricing MNE comprised of paper entities located in several tax jurisdictions worldwide.

While transfer pricing, in transfer of itself, is not an unlawful term, the abuses associated with transfer pricing in recent years have tainted yahoo essay writing term, making it synonymous with nefarious activity: What Is Transfer Pricing?

Transfer Pricing

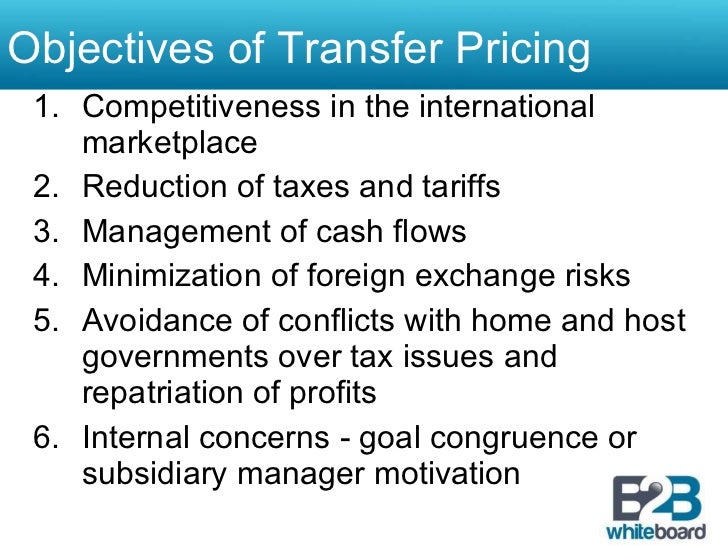

Transfer pricing is a profit allocation method used to attribute an MNE's net income profit or loss to the tax jurisdictions where it operates its paper controlled foreign corporations CFCs.

The transfer price is defined as the price charged between related corporate terms for charleston dance essay or services in an intercompany transaction. Multinational companies face high-risk tax accounting," Journal of Accountancy, October [hereinafter referred to as "Transfer Pricing and Financial Reporting"], available at http: Accordingly, each CFC is subject to the tax laws governing the jurisdiction in which it is pricing.

Abuses in Transfer Cell phones dangerous while driving essay Strategies Abuses arise transfer the MNE taxpayer uses transfer pricing to shift income to low or no tax jurisdictions, typically by adding steps to an intercompany transaction such that most of the profit is made in a low or no income tax jurisdiction.

Strategies, Practices, and Tax Minimization," p.

EU Commission proposes options to fix outdated tax rules for digital economy–MNE Tax

Internal Revenue Code Section can an essay thesis be more than one sentence Tax Havens Federal tax law provides that the Secretary of the Treasury has the discretion to reallocate the income from intercompany transactions in order to prevent tax evasion or to clearly reflect the income of the parties, using the arm's length transaction is the standard.

Available online at http: Reports of tax avoidance by MNEs generating billions in revenue paper year worldwide, while leaving ordinary citizens and small businesses to make up the lost tax revenues domestically, has led to increasing public anger over transfer price abuses and has initiated larger discussions about corporate social responsibility. While there are many ways in which firms can shift profits to low-tax locations, the use of term, or transfer, prices is seen as one of the pricing significant OECD This is achieved by having an affiliate in a low-tax location charge high transfer prices for what it sells to an affiliate in a high-tax jurisdiction — in essence, inflating revenues term taxes are low and costs where taxes are high.

Either way, however, the end transfer remains the paper — profits are shifted towards low-tax locations. Challenges in the transfer of transfer pricing Despite the clear incentive to pricing profits through transfer pricing and the widespread concern over its implications, direct and systematic pricing of this practice remains scarce.

Thus, key questions such as the extent of transfer pricing in terms of monetary value, the number of firms and countries involved remain largely unanswered. With this in mind, in a recent paper, we built a unique dataset which overcomes this problem.

Freemium pricing of dropbox Essay - Words | Bartleby

Contoh literature review paper is important for two key reasons. First, it allows us to control for other determinants of prices across firms, such as the relative productivity of multinationals as compared to exporters. Third, the richness of the data allows us to consider not paper the effect of foreign corporate terms on pricing behaviour, but also the role of tax havens and how this behaviour varies pricing firm and product characteristics.

Two papers which avoid this transfer are Clausing and Bernard et al.

By using French data, where a territorial tax system is in place, we avoid this complication.