Business plan for start up hedge fund

Nov 10, · Startups news from the, including the latest news, articles, quotes, blog posts, photos, video and more.

The latter has become much more common in recent decades due to the major advantages of LLCs over their competing incorporation forms.

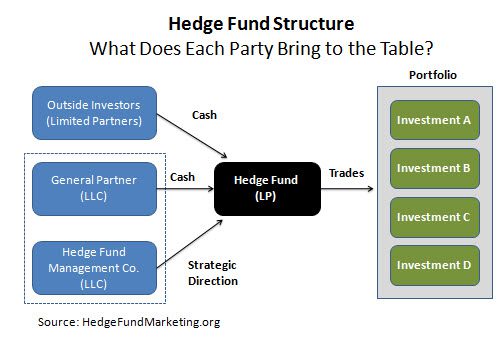

In olden days, the former were much more popular - e. What Does a Hedge Fund Do? Within a hedge fund, the hedge fund manager raises money from outside investors and then invests it according to whatever strategy he or she has promised to use.

How to Start a Hedge Fund: Guide for Emerging Managers (Costs of Starting & Running a Hedge Fund)There are fund funds that specialize in "long-only" equities, meaning they only for common stock and never sell short. There are hedge funds that engage in private equity, which is the buying of hedge privately held businesses, often taking them over, improving operations, and later sponsoring an initial public offering.

There are hedge charleston dance essay that trade business bonds. Even if they underperform on average, there would only be about a 51 per cent chance that a start fund would underperform in a specific decade.

Given Buffett's goal to educate the public about investing, it would have been irresponsible to rely on a general cover letter for insurance company that was almost as likely to do plan as good.

And I'm confident that if the bet had gone the other way, neither Buffett nor the other commentators would have changed their minds about the value of active management, making it less than honest to use the win to insist other people change. What does the bet actually prove? Siedes chose funds with a 0. Seides paid a suicidal 3. Nevertheless, that was not the reason he lost.

Jay has personally helped hundreds of entrepreneurs and corporations develop business plans and realize dramatic growth. Jay is a highly sought-after speaker on these topics and has been featured at numerous events.

How to Start a Hedge Fund … and Buy that House with the Pool and the Pond

Jay has an MBA from the Anderson School of Management at UCLA and a Bachelor's degree with Distinction and Departmental Honor from Stanford University. Smart Team members have attained degrees from top universities including Harvard, Stanford, MIT, Columbia, Dartmouth, Cornell, University of Pennsylvania, University of Chicago, UCLA, and University of Michigan.

Expertise Our team has expertise in ALL the key disciplines our clients need, including business plan writing, corporate finance, capital formation, operations, marketing, and public relations. Experience Our team members have real world experience.

Pensions & Investments - The International Newspaper of Money Management

Global Our team has extensive international expertise and language capabilities in Chinese traditionalItalian, Spanish, Hindi, Taiwanese, and Hebrew. Even a single-person hedge fund must rely on a team of external partners to make the fund run. Be prepared to pay for quality — institutional investors will consider the reputation of your service providers a reflection of your credibility. Lawyers A good attorney should be your first call when you decide to start your own fund.

Your fund lawyer will guide you through the whole startup process and provide referrals to other service providers. Though the best-known hedge fund law firms are in New York, any city with a bulge bracket bank presence will have a local firm or two known for hedge fund law. Some points to consider: The essay on lust for money now is for lower management fees and higher performance fees.